In late October, the European Council announced that it will ban the sale of new internal‑combustion‑engine cars by 2035, pushing the continent toward a zero‑emission future. The same week, a surge of news coverage highlighted the global surge in electric‑vehicle (EV) orders—companies like Tesla, Volkswagen, and Hyundai are all announcing record‑breaking production ramp‑ups. Consumers, regulators, and manufacturers alike are buzzing about a future where electric propulsion becomes the norm. Amid this hype, one often‑overlooked component is quietly responsible for turning high‑speed motor output into the torque that propels the vehicles: the gear motor, or reducer motor.

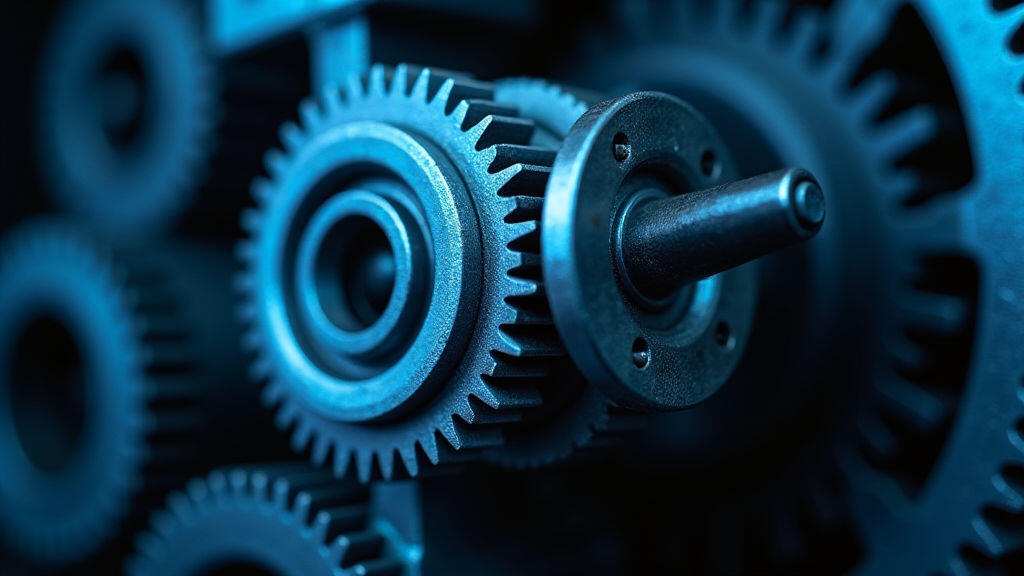

All electric cars use a motor to convert electrical energy into mechanical rotation. But the motors that drive these vehicles are typically high‑speed, low‑torque units—perfect for generating power but not optimal for moving a car that weighs a fraction of that mass. The solution is a gear reducer—a device that reduces the motor’s speed while increasing torque. By incorporating a gear motor, manufacturers can combine the motor and reducer into a single compact unit, simplifying assembly and reducing size and weight.

This “all‑in‑one” approach is especially valuable in EVs because any added weight or bulk directly cuts range. By using a tightly engineered gear motor, automakers keep the drivetrain leaner and improve the overall efficiency of the vehicle.

The EU’s 2035 ban has created a wave of investment in battery plants, charging infrastructure, and R&D for powertrain components. Manufacturers such as Volkswagen’s Porsche, Hyundai’s Ioniq, and BML (Bosch, Medtronic, and Lilium) are all revitalizing their gear‑motor lines to meet tighter performance targets. The trend isn’t limited to Europe; in China, the government’s “Made in China 2025” plan involves significant subsidies for EV-related tech, including advanced reducers.

These market dynamics influence the gear motor sector in several ways:

Material Innovation

To keep weight down and efficiency high, producers are experimenting with lightweight alloys and composite materials for gears. Advanced steel alloys can handle the same torque while being lighter, which means fewer lost energy losses due to heat.

Size Contraction

As battery i the EV industry improves pack energy density, designers are expected to keep the overall vehicle footprint tiny. This means gear motors must shrink while maintaining or improving the torque-density ratio.

Custom Tuning

Different vehicle classes—compact city cars, SUVs, and even heavy‑duties like delivery vans—require distinct torque curves. Manufacturers now offer a palette of gear‑motor options, from a 1:5 gear ratio for quick acceleration to a 1:20 ratio for high‑speed performance.

Sustainability Focus

Beyond performance, carbon footprints are under scrutiny. Gear motor makers are looking at regenerative manufacturing processes, and thermally efficient designs reduce cooling energy needed, which in turn reduces battery drain.

The same industrial automation buzz that fuels the robotics revolution is now spilling into gear‑motor production. High‑precision CNC machines, paired with machine‑learning quality‑control algorithms, reduce defects in gear teeth geometry, boosting the overall reliability of EVs’ critical powertrains. Meanwhile, AI‑optimized design tools correlate customer‑specific torque requirements with 3D-printed prototypes, speeding up development cycles.

The gear‑motor industry is experiencing a significant upswing in global trade. Countries that produce flat‑bed, high‑precision gear motors stand to capture growing shares of the EV market. While China's mass production capabilities are hard to beat, Western manufacturers boast advanced materials and precision, allowing them to export high‑grade gear motors to niche markets (luxury electric vans, autonomous delivery robots).

Importantly, the gear‑motor market itself is projected to grow at an average annual rate of 6% over the next decade—an uptick driven almost entirely by EV demand. Supply‑chain resilience will be crucial as micron-sized gear designs (to resist wear and increase lifespan) become the norm in high‑performance electric drives.

Governments worldwide are tightening emissions standards. The gear‑motor’s role in improving drivetrain efficiency dovetails nicely with regulatory goals. By reducing motor size, gear motors lower both vehicle weight and battery demand, translating into reduced greenhouse‑gas emissions per kilometer. This synergy offers automakers an extra angle to meet targets: smarter, lighter gear motors mean less battery energy and thus less pollution.

Such innovations will keep gear motors at the center of the evolving automotive landscape, even as vehicle technology leaps forward.

The EU’s bold 2035 ban on gasoline cars, the rise of battery‑powered competition, and the incessant demand for sustainable mobility have all converged on a single, unsteady hero: the gear motor. By converting high‑speed electrical output into the torque necessary for vehicles to move efficiently, gear motors have become indispensable to the EV push. As material science, AI, and regulatory frameworks push the standards higher, the gear‑motor industry will continue to innovate, keeping our cars lighter, greener, and smarter. In the grand narrative of the green transportation revolution, the reducer motor may not be the flashiest component, but it is undeniably a backbone powering the future.

Leave A Reply

Your email address will not be published. Required fiels are marked